Trump’s 25% Tariff Plan: Long-Term and Short-Term Effects on Your Home Value and Home Buyers

Today, I want to talk about something that could have a big impact on Canada’s economy—and even on our real estate market. Trump has announced a 25% tariff on Canadian goods starting February 1st. What does this mean for home prices here?

This tariff means Canadian goods sold to the U.S. could cost more, which might hurt many industries, like manufacturing and farming. It also brings a lot of uncertainty to our economy. So, how will this affect your ability to buy or sell a home? I’ll explain both the short-term and long-term possibilities

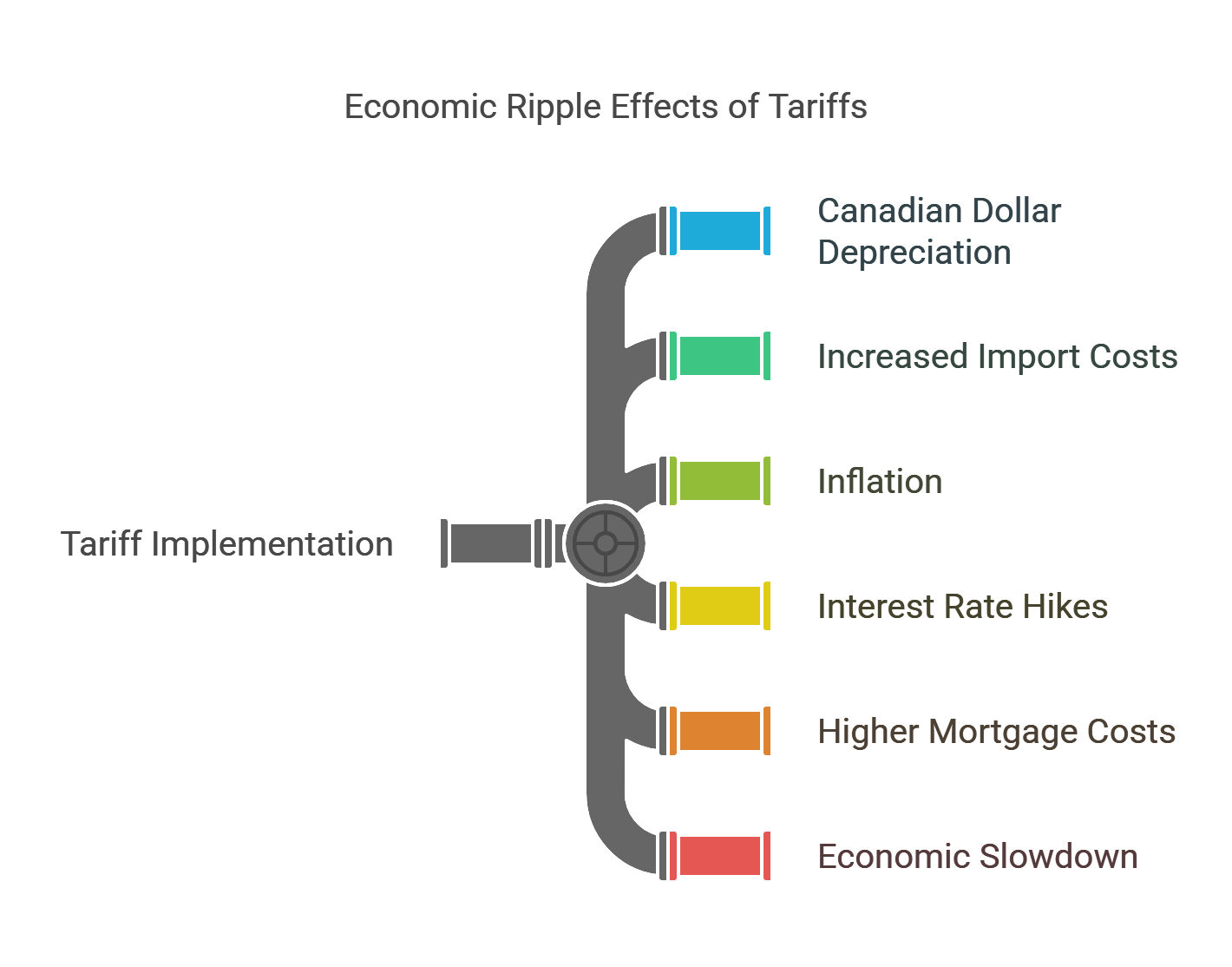

Immediate Economic Impacts

If this tariff goes into effect, it could cause the Canadian dollar to drop in value. When our dollar is weaker, everything we import—like food or materials—gets more expensive. That can lead to higher prices overall, which we call inflation. If inflation goes up, the Bank of Canada might raise interest rates to keep it under control. And higher interest rates mean higher mortgage costs for buyers.". U.S. is Canada's largest trading partner, with approximately $3.6 billion worth of goods and services crossing the border daily. A slowdown could result in job losses and reduced consumer spending.

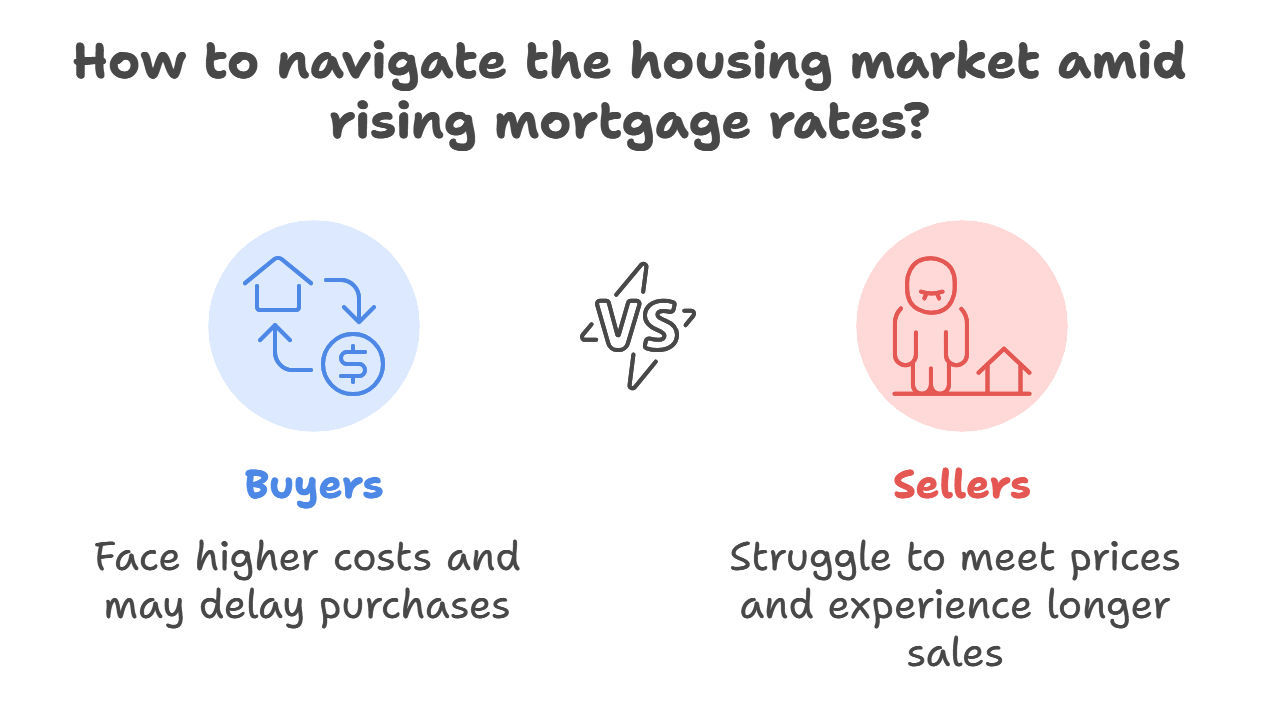

Short-Term Impact on Home Prices

In the short term, this could make buying a home more expensive, since mortgage payments would go up with higher rates. Buyers might take a step back to see how things play out, which could slow the market. Sellers might find it harder to get their asking price, and homes could stay on the market longer than usual.

Long-Term Impacts

Over time, things could stabilize, but it depends on how both Canada and the U.S. handle these tariffs. If the economy slows down, the real estate market might face more challenges. However, some opportunities could also arise—like more foreign buyers seeing Canada as a good investment, especially if our dollar stays low. But the truth is, no one can predict the exact outcome right now.